With the rapid advancement of pharmaceutical technology, the pharmaceutical industry is quietly changing. Following PD-L/1 monoclonal antibody, CAR-T cell therapy, and ADC (antibody-coupled drug), double-antibody drugs have become another major trend in the industry. Double antibody drug is the abbreviation of bispecific antibody. Compared with monoclonal antibody, it adds a specific antigen binding site, which is more specific, can target tumor cells more accurately and reduce off-target toxicity. It has more advantages in aspects and is known as "the next generation of antibody drugs".

8 dual-antibody drugs approved for marketing in the world:

Since the first dual-antibody drug (Catumaxomab) was launched in 2009, a total of 8 dual-antibody drugs have been approved for marketing in the world. Especially this year, four dual-antibody drugs have been launched intensively, including Roche’s Faricimab, which was approved for marketing in the United States in January, Roche’s Mosunetuzumab, which was conditionally approved for marketing in Europe in June. In June, Akeso Biotech, which was approved for marketing in China, and Johnson & Johnson Teclistamab, which was approved for marketing in Europe in August.

Benefiting from the expanding scope of indications, good clinical efficacy and safety, the market scale of dual-antibody drugs continues to expand. With the acceleration of the listing process, it is estimated that the global bisantibody market size is expected to reach 80.7 billion US dollars in 2030. Domestically, as of the end of September, 3 dual-antibody drugs have been approved for marketing in my country, and more than 30 domestic companies such as Akeso Bio, Corning Jerry, BeiGene, Innovent Biologics, and Hengrui Medicine have deployed.

More than 700 drugs are under research, and the research and development of double-antibody drugs is hot:

The barriers to research and development of dual-antibody drugs are high, but the future market space is broad, so the number of companies entering the field of dual-antibody drugs is increasing globally. According to the statistics of Rubik’s Cube, there are currently more than 700 dual-antibody drugs under development in the world, of which nearly 300 have entered the clinical stage, and 2 new drugs are in the NDA stage, namely AbbVie and Roche’s CD3/CD20 products. At present, there are more than 300 dual-antibody drugs under research in China, of which nearly 100 drugs have entered the clinical stage, and 6 drugs are in the phase III clinical trial stage.

Judging from the research and development progress of global and domestic dual-antibody drugs, most of them are still in the early stage. Relatively few drugs have entered the second phase, third phase and NDA, and some drugs have obvious first-mover advantages. It is worth mentioning that the R&D investment of Chinese pharmaceutical companies in the field of double-antibody is in a leading position in the world, which can be reflected in the number of clinical trials.

The FAI climbed 5.9 percent year-on-year in the first 11 months of 2018, quickening from the 5.7-percent growth in Jan-Oct, the National Bureau of Statistics (NBS) said Friday in an online statement.

The key indicator of investment, dubbed a major growth driver, hit the bottom in August and has since started to rebound steadily.

In the face of emerging economic challenges home and abroad, China has stepped up efforts to stabilize investment, in particular rolling out measures to motivate private investors and channel funds into infrastructure.

Friday's data showed private investment, accounting for more than 60 percent of the total FAI, expanded by a brisk 8.7 percent.

NBS spokesperson Mao Shengyong said funds into weak economic links registered rapid increases as investment in environmental protection and agriculture jumped 42 percent and 12.5 percent respectively, much faster than the average.

In breakdown, investment in high-tech and equipment manufacturing remained vigorous with 16.1-percent and 11.6-percent increases respectively in the first 11 months. Infrastructure investment gained 3.7 percent, staying flat. Investment in property development rose 9.7 percent, also unchanged.

English

English

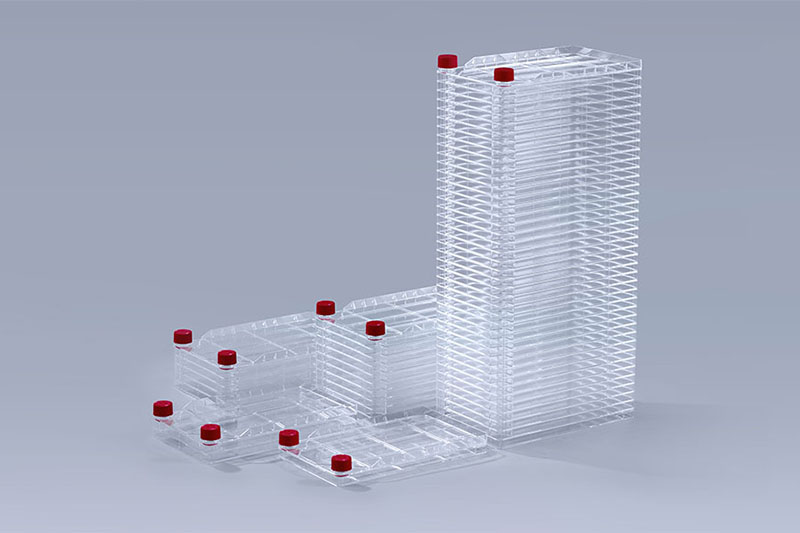

Cell Factory

Cell Factory PETG Media Bottles

PETG Media Bottles