The U.S. Food and Drug Administration regulates biological products, or biologics, which have transformed the treatment of many illnesses and are the fastest-growing class of medications in the U.S. Biologics offer hope and healing to millions of Americans, but they can be expensive. In 2021 alone, the U.S. spent $256 billion on biologics. Although biologics comprise approximately 3% of prescriptions in the U.S., these products account for over half of prescription medicine spending. This is not sustainable for either the patients who need these medicines or for our health care system. That is why the FDA and the Federal Trade Commission (FTC) have been working together to help advance competition for biologics, including biosimilars and interchangeable biosimilars.

To help reduce costs and increase access to biologics, the Biologics Price Competition and Innovation Act of 2009 (BPCI Act) created an abbreviated approval pathway to provide patients with access to safe and effective biosimilars.

A biosimilar is highly similar to, and has no clinically meaningful differences from, an FDA-approved biologic (called a reference product).

Biologics are used to treat many illnesses, including chronic skin diseases, inflammatory bowel disease, rheumatoid arthritis, kidney conditions, diabetes, macular degeneration, and cancer. Biosimilars and interchangeable biosimilars can provide greater access to biologic treatment options and potentially reduce costs for patients and the health care system through market competition.

We are seeing progress in terms of cost savings. According to an Association for Accessible MedicinesExternal Link Disclaimer report, savings from biosimilars totaled $7 billion in 2022. This $7 billion represents more than half of the total savings (over $13 billion) that biosimilars have generated since the first biosimilar was marketed in 2015. The report data also show that the average sales price of a biosimilar is less than half the price of the reference product at the time of launch. Overall, market competition is leading to reduced costs for both biosimilar and reference products.

FDA and the Federal Trade Commission Collaboration

However, a competitive and robust marketplace for biologics is not a guarantee. There are many roadblocks that can delay competition, such as “patent thickets,” or groups of overlapping patents that can hinder the development and availability of biosimilars. The FDA and the FTC have been working together to help advance competition for biologics, including biosimilars and interchangeable biosimilars. The agencies have a long history of collaborating to protect American consumers, including our joint efforts to support the appropriate adoption of biosimilars, address false or misleading statements about these medications, and deter anti-competitive behaviors in the biological product marketplace.

We detailed our commitments in the Joint Statement of the Food & Drug Administration and the Federal Trade Commission Regarding a Collaboration to Advance Competition in the Biologic Marketplace. In March 2020, we held a joint public workshop on a Competitive Marketplace for Biosimilars. At this workshop, participants from industry, academia, and government agencies discussed competition in the biologics market. To further support our coordinated efforts in this area, the FDA and the FTC drafted a summary report of the workshop to capture the discussion in an easy-to-read overview of the important issues discussed at the workshop. Since the workshop, the agencies have worked together on issues such as exchanging information about how to combat activities that undermine competition and/or harm the public health.

FDA and FTC Work to Address False and Misleading Information

As outlined in the joint statement and the 2020 workshop summary, the FDA and the FTC share concerns about false or misleading information and their negative impacts on public health and drug competition. For example, deceptive or misleading comparisons of reference products to biosimilars or biosimilars to interchangeable biosimilars undermine public health and may constitute unfair or deceptive practices that undermine confidence in biosimilars. Our agencies want to ensure that patients and health care providers receive truthful and non-misleading information about biological products to inform their treatment decisions.

To that end, the FDA and the FTC have developed an educational resource for consumers about biosimilars and interchangeable biosimilars to help address common misperceptions. Unwarranted concerns may discourage patients and their health care providers from using or switching to a biosimilar, so it is important to know the facts. Unbiased information can help patients and their providers understand the treatment options available.

There are currently 40 FDA-approved biosimilars, 27 of which are on the market, and there are over 100 biosimilars in the development pipeline for more than 50 different reference products. As this promising area of medicine continues to grow, our goal is to support and advance healthy market competition and accurate information about biosimilars.

Source: https://www.fda.gov/news-events/fda-voices/fda-and-ftc-collaborate-advance-competition-biologic-marketplace

The FAI climbed 5.9 percent year-on-year in the first 11 months of 2018, quickening from the 5.7-percent growth in Jan-Oct, the National Bureau of Statistics (NBS) said Friday in an online statement.

The key indicator of investment, dubbed a major growth driver, hit the bottom in August and has since started to rebound steadily.

In the face of emerging economic challenges home and abroad, China has stepped up efforts to stabilize investment, in particular rolling out measures to motivate private investors and channel funds into infrastructure.

Friday's data showed private investment, accounting for more than 60 percent of the total FAI, expanded by a brisk 8.7 percent.

NBS spokesperson Mao Shengyong said funds into weak economic links registered rapid increases as investment in environmental protection and agriculture jumped 42 percent and 12.5 percent respectively, much faster than the average.

In breakdown, investment in high-tech and equipment manufacturing remained vigorous with 16.1-percent and 11.6-percent increases respectively in the first 11 months. Infrastructure investment gained 3.7 percent, staying flat. Investment in property development rose 9.7 percent, also unchanged.

English

English

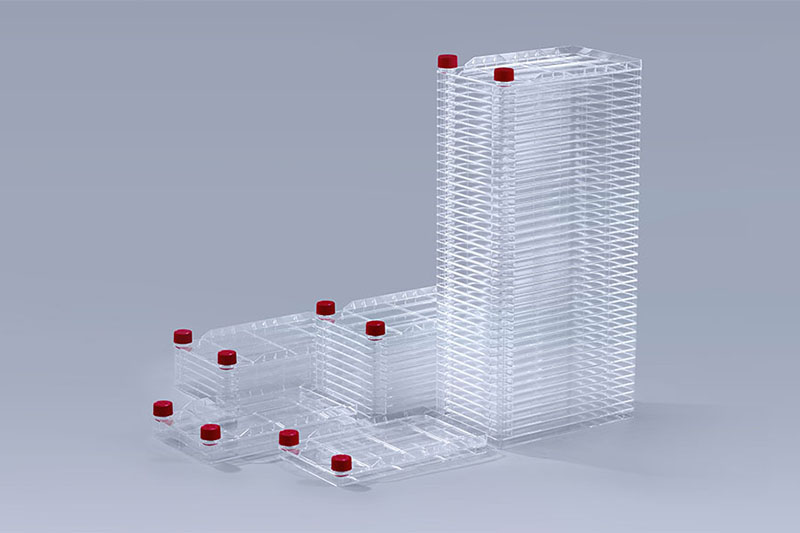

PETG Media Bottles

PETG Media Bottles Cell Factory

Cell Factory Erlenmeyer Shake Flasks

Erlenmeyer Shake Flasks